Share

0

/5

(

0

)

The global financial sector has seen several digital innovations in recent years. New technology has helped financial organisations overcome geographical constraints, streamline processes, and provide new benefits. However, increased prospects have also created new obstacles and substantial concerns for financial organisations.

Customer verification has become a major challenge in 2023 since malicious attackers and cyber criminals could simply access their systems under fake identities. This has led to identity theft, asset relocation, money laundering, and other financial crimes. To eliminate these risks, companies have adopted know-your-customer (KYC) procedures and practices.

Key Takeaways

The know-your-customer methodology is a set of rules and principles that help companies identify suspicious customer profiles.

KYC practices are highly encouraged for all businesses operating online. They are mandatory for all companies subject to AML/CTF regulations.

Following KYC practices enable companies to stay compliant and ensure security against substantial cyber threats.

Companies should consider the quality and speed of services, reputation, and compliance to select a perfect KYC provider.

What Is KYC And Why It Is An Essential Practice

Know Your Customer (KYC) compliance practice dictates security procedures and requirements needed to safeguard companies from various customer-related risks and threats. Additionally, KYC enables companies to track and verify documents, sensitive data and questionable transactions. KYC practices also assist companies in their compliance efforts, ensuring that they fulfill counter-terrorist financing (CTF) and anti-money laundering laws (AML).

Thus, KYC is an indispensable security practice for financial companies, keeping them in line with industry regulations and ensuring two-way safety in their client relationships. With KYC, companies across different industries can detect fraud and other digital crimes in advance.

Otherwise, companies risk exposing their remaining customers to various significant risks. Even a single instance of fraud or similar incidents can put a given company's reputation in jeopardy, leading to customer outflow. Such incidents are extremely hard to recover from in terms of customer relationships. With KYC practices, companies avoid damaging their solid reputation and give customers peace of mind.

[aa quote-global]

Fast Fact

KYC guidelines were created in 1970 when the US established the Bank Secrecy Act (BSA) to combat money laundering. Years later, following 9/11 and the 2008 financial crisis, notable additions were made.

[/aa]

How KYC Works

According to KYC, companies must identify their customers precisely by retrieving their personal information and assessing the potential risks related to their customer profiles. While customers might provide every pertinent document and detail without any errors, they might still be suspicious due to questionable transactions and other activities on the platform.

The process of evaluating customer risks is called customer due diligence. This procedure can be handled and analyzed in various ways, as different industries and markets have distinct customer-related risks.

Thus, the KYC process is continuous, as companies must actively monitor relatively riskier customer profiles. The risk factor of various customers is determined through their initial identification checks. In this process, companies can have different KYC procedures to ensure the validity of a customer.

Companies have varying levels of KYC protection, from trivial checks like government IDs and advanced biometric verifications to comprehensive digital searches. The extent of customer identification procedures depends on the local laws, regulations, and security preferences of a given business.

Which Companies Require KYC Verification?

While KYC methodology is popular with financial institutions, numerous other industries could greatly benefit from KYC adoption. However, for some sectors, KYC is necessary per government laws. Any business that is under the AML/CTF regulations is required to implement KYC practices. Most AML/CTF laws cover the financial sector, including banks, various brokers, investment funds, real estate companies, etc.

However, this does not mean that KYC only benefits companies that aim to stay compliant. Since numerous businesses have undergone a digital transformation and service their customers online, the threats of fraud and similar cyber crimes have become more prevalent worldwide. Thus, any companies with digital platforms should consider adopting KYC norms to ensure that their services will not be corrupted by malicious attackers disguised as regular customers.

Benefits of KYC Methodology

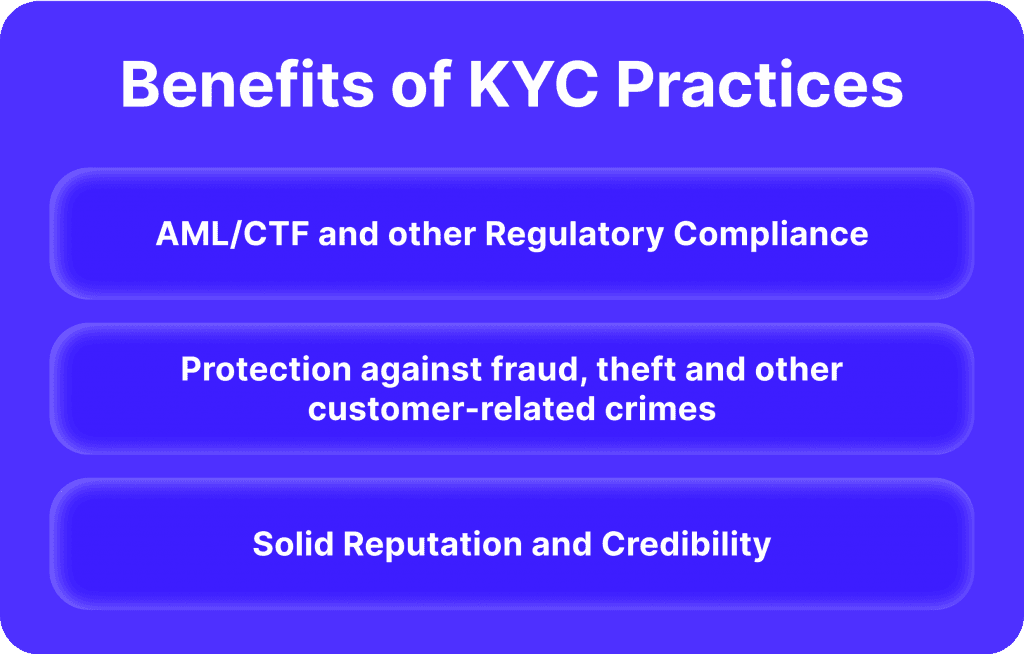

As mentioned above, KYC practices are fundamental pillars of ensuring security against cyber crimes from suspicious customers. While adopting customer verification methodologies might prove arduous, they produce numerous benefits for respective organizations:

1. Regulatory Compliance

The exponential growth of digital solutions has incentivized numerous sovereign entities to implement appropriate safeguards against cybercrime. Thus, governments across the globe have introduced strict laws regarding customer verification to negate the threats of fraud, money laundering and terrorist financing activities.

As of 2023, most financial sectors and similar industries must comply with AML/CTF regulations and other related protocols. Failure to reach sufficient compliance might lead companies to lose their professional license or even be subject to federal law. Therefore, following KYC legal requirements is paramount for regulated industries.

Thankfully, adopting the latest KYC practices has become less challenging than before. Now, KYC providers assist companies in implementing appropriate methodologies without hassle, integrating all relevant protocols and checks into their existing IT infrastructure. As a result, companies can operate confidently, knowing they can maintain total compliance with respective AML regulations.

2. Protection Against Money Laundering And Financial Crime

While many companies might implement KYC verification simply to stay compliant with regulations, KYC practices are indispensable security measures against fraud, money laundering, bribery and other major criminal activities. The KYC approach has become increasingly essential as cybercrime has reached unprecedented heights across the globe.

Global cybercrime is expected to cost $8 Trillion in damages in 2023 alone, an alarming statistic for all digital industries. However, implementing cutting-edge KYC practices can alleviate most of the customer-related cyber risks. Methods like identity verification, background checks, customer due diligence and continuous transaction monitoring can prevent potentially massive cyber breaches.

However, the success of KYC methodologies depends on how well the companies implement their protocols and whether they dedicate enough resources to comprehensive customer checks. Additionally, companies must showcase diligence in terms of advanced risk management, being able to identify accounts with seemingly clean track records.

3. Sturdy Reputation

Aside from staying compliant and secure, companies should prioritize their clean track record and solid reputation. Adopting KYC verification is not just an excellent way to ensure maximum security, but a great signal for potential customers to develop trust and loyalty. With increasing cybercrime statistics worldwide, customers wish certain assurances that their sensitive information and assets are safe from such unfortunate events.

With KYC practices in place, companies can swiftly showcase that they have appropriate means to combat financial crime and other cyber threats. Moreover, many organizations include KYC certifications and practices in their marketing efforts to highlight robust security measures. This is an outstanding strategy for developing a solid brand presence in numerous markets. As a result, adopting KYC methodology can enhance the quality of customer relationships and brand loyalty, paving the way toward long-term business success.

Essential Steps in Conducting a Thorough KYC Checking

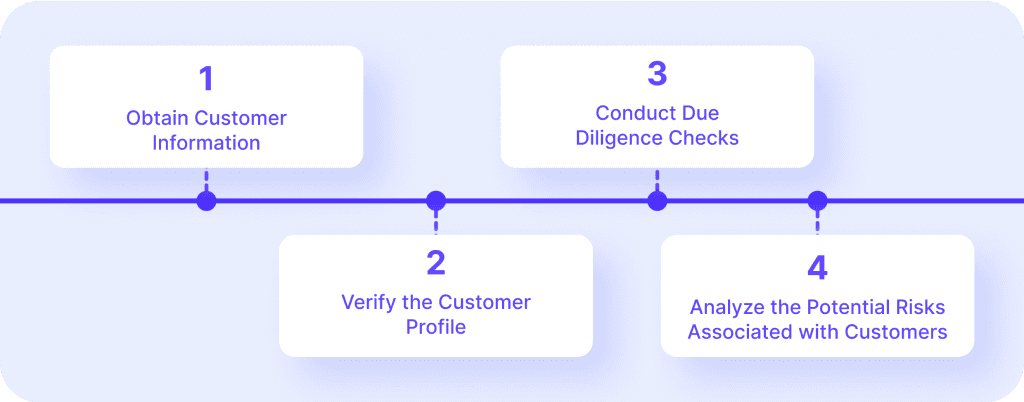

While many variations and contextual details exist, KYC procedure principles are universal across industries. The critical steps are as follows:

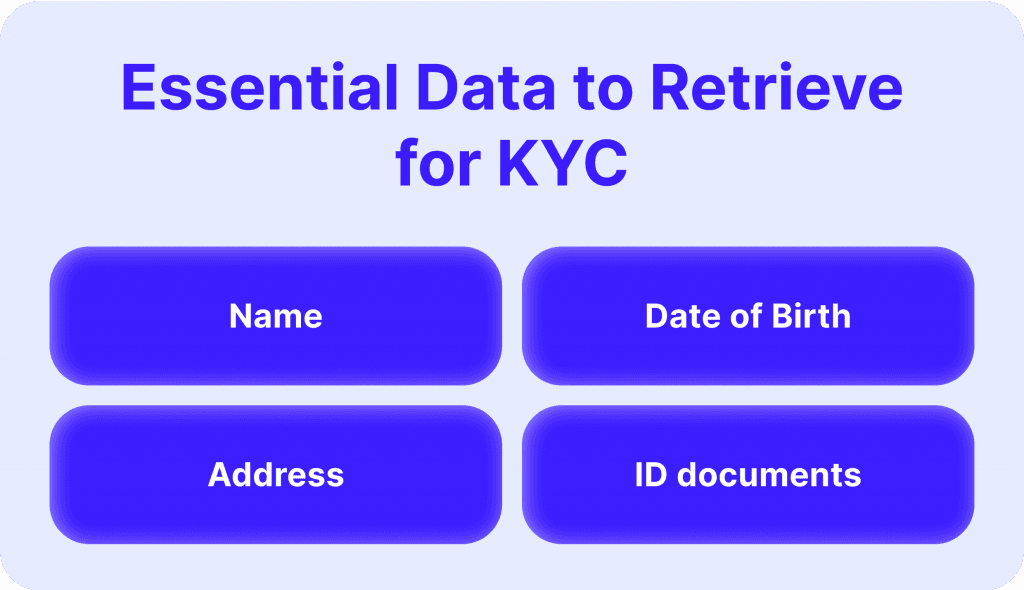

Customer Identification Program (CIP) – As the CIP procedure dictates, companies should retrieve the customer's name, date of birth, residing address and ID document. These four data points are essential to construct a basic customer profile and check whether the customer exists.

Customer Due Diligence (CDD) – with the CDD procedure, companies must analyze all obtained customer information and the potential risks tied to this specific profile. Some customers might require enhanced due diligence (EDD) checks, as their profile might signal significant potential risks. EDD relates to industry-specific verification, as different sectors require custom risk-identification strategies.

Continuous Monitoring – Last but not least, companies should regularly update customer profiles, analyzing unusual transactions and other suspicious activities. Since many customer profiles might be initially clean and become corrupted later on, monitoring any material changes and re-evaluating the potential risks is essential.

Tips for Choosing a Perfect KYC Provider

While KYC practices might prove challenging to set up, there are numerous KYC providers that simplify KYC adoption and let companies seamlessly integrate appropriate protocols into their IT ecosystems. Hiring a KYC provider can be a great strategy in a number of ways. From enhanced proficiency and timely security updates to cost-efficiency, KYC providers are an optimal solution for companies with small to mid-sized budgetary capabilities.

Companies must consider several factors when choosing a perfect KYC provider. Different KYC providers offer varying levels of automation, manual inspections, customized risk management techniques and other relevant features. Thus, companies must evaluate their specific security requirements and decide which option suits their needs. Aside from functionality and offerings, companies must examine KYC providers with the following elements:

Compliance with Laws and Regulations

When deciding to outsource KYC practices to a third party, it is essential to verify that they are thoroughly compliant with all relevant laws and regulations. The compliance requirements may vary in different countries and regions, but the general rule is to select a KYC provider that has a perfect compliance track record.

KYC providers with questionable compliance efforts must be avoided completely, as this goes against the very nature of adopting KYC practices in the first place. Moreover, the lack of compliance might signal significant issues with the KYC provider's services. In most cases, compliance failures mean that a given KYC provider is not well-equipped to handle all KYC-related security concerns.

Strong KYC Features and Offerings

While consistent compliance is highly indicative of strong KYC practices, it does not guarantee that KYC providers have all of the latest safeguards in place. Thus, customers must carefully examine their options and select a KYC provider that employs all essential security measures. As a rule of thumb, KYC providers must have sturdy customer identification and due diligence protocols. Additionally, they should offer advanced monitoring tools for unusual transactions and other activities.

Aside from core competencies, KYC providers offer complex analytical tools to identify more complex cases of fraud or identity theft. Such tools might include advanced behavioral analysis of potential suspects, carefully monitoring their activities and identifying any unusual occurrences in terms of timing, transaction amounts and other metrics.

It is up to the companies to decide what level of KYC features they need for their respective platforms, considering the nature of their industry, their target audience and budgetary constraints. However, it is always crucial to select a KYC provider that offers the core protocols. Otherwise, the entire KYC service might be ineffective.

Established Reputation

Another significant factor to be considered is the KYC provider's overall history of providing quality services. When it pertains to the security market, a solid reputation is not easily earned, as even singular incidents might cause irreparable damages to the provider's goodwill.

KYC providers with airtight and well-established reputations are great candidates for delivering excellent services. Remember, when it comes to ensuring safety against financial crime, fraud and money laundering, companies cannot take chances with unproven or questionable KYC provider brands. So, it is crucial to carefully examine selected KYC providers and verify if they have provided expert services for the duration of their existence. This way, the chances of incompetence or lackluster services are greatly reduced.

Speed and Efficiency

Despite the fact that KYC procedures are vital for maintaining a safe digital environment, customers might still be unhappy if they encounter long processing and verification periods. After all, customers value convenience and efficiency. Companies might risk losing a sizable portion of their audience if their speed is sacrificed for KYC compliance efforts.

Therefore, choosing a KYC provider that delivers high-quality security practices without inconveniencing the platform users is crucial. KYC providers who offer fast processing times and efficient verification protocols are highly valued in the industry. However, it is important to find a KYC provider that finds a perfect balance between speed and quality.

Final Takeaways

The know-your-customer methodology has become a core security element for companies with digital platforms and online customer interactions. With KYC norms properly implemented into the IT infrastructure, companies can quickly identify suspicious customers and take appropriate measures before the damage is done.

Read also